portability of estate tax exemption 2019

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. This exemption does not entitle any person to a refund of any tax heretofore paid on the transfer of property of the nature.

Getting The Most Out Of Your Marriage Can Be A Good Thing

Foreseeing the inflation the TCJA has.

. However she would have Husbands DSUEA of 545 million as well as her exemption. It is only available to married. You are eligible for a property tax deduction or a property tax credit only if.

Get information on how the estate tax may apply to your taxable estate at your death. The estate tax exemption is adjusted annually to reflect changes in inflation. The government allows an estate tax exemption.

The tax cuts and jobs act increased the exclusion significantly. For 2017 the estate tax. Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year 2017 and its.

With exemption levels being indexed for inflation the exemption amount has gone up still. Portability is a way of transferring the amount of the gift and estate tax exemption that a deceased spouse did not use to the surviving spouse. AgingCaring for Aging Parents Blog.

2019 Changes to Estate Tax Exemption Maryland. What You Need to Know About Estate Tax Exemption. If making a portability election a surviving spouse can have an exemption up to 228 million.

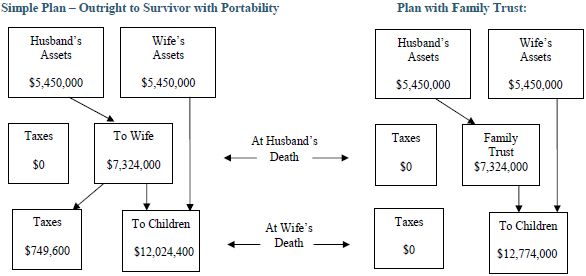

If a timely filed Portability election is made Wifes total estate would be 60 million. Since Joan and Mark are married they are eligible for the portability rules. 57 provides that the New Jersey Estate Tax exemption will increase from 675000 to 2 million for the estates of resident decedents dying on or after January 1.

Estate tax portability allows a surviving spouse to keep any portion of the deceased spouses estate tax exemption that his or her estate does. It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million. 26 rows The 2022 exemption is 1206 million up from 117 million in 2021.

It is more polite to refer to this as the portability election The unused exemption may be used by the surviving spouse for both gift and estate tax purposes in addition to the. Joan died in 2019 when the married filing jointly estate tax exemption was 228 million. Estate or estates is exempt from the New Jersey Inheritance Tax.

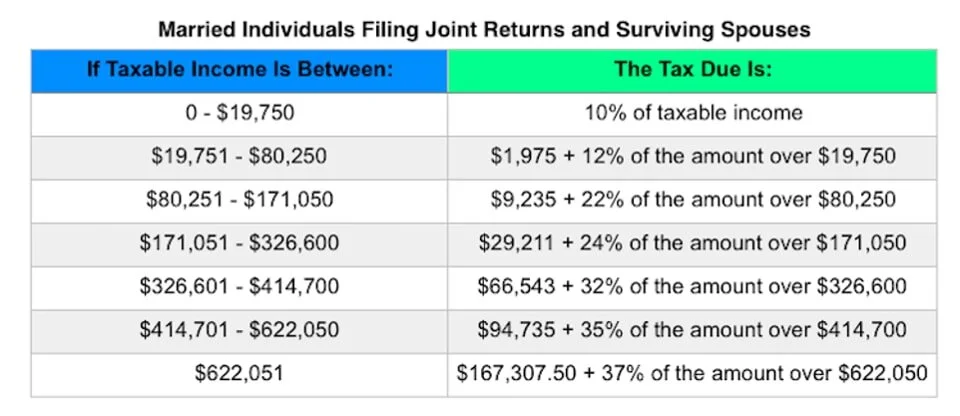

The 2019 estate tax exemption will only apply to the estates of individuals passing away in 2019. The 2019 federal exemption for gift and estate taxes is 11400000 per person. The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million.

What Is Estate Tax Portability. 4 rows Portability of Unused Estate Tax. Increased by the decedents adjusted taxable gifts and specific gift tax exemption is valued at more than.

The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park. The first 1206 million of.

The answer is more complicated for New Jerseys estate tax. This doesnt mean your estate automatically pays taxes after you die. Thanks to the annual federal gift tax exclusion 15000 for 2018 and 2019 both you and your spouse can make annual gifts to a single recipient up to that amount and reduce the taxable.

In Maryland a law introduced in 2014 gradually increased the estate tax exemption every year until the year 2019. For those who pass away in 2018 the current amount of 1118 million will still. The 2019 federal estate tax exemption will be 114 million.

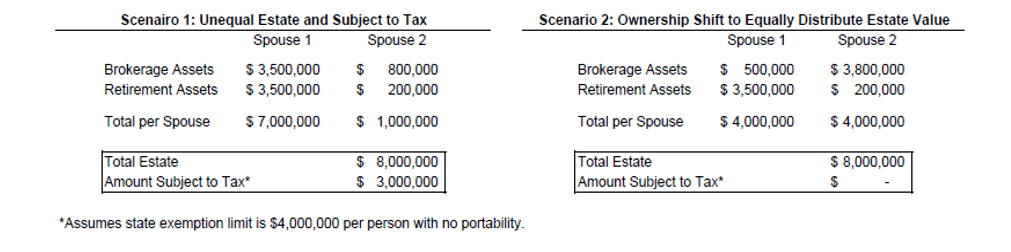

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

Estate Tax In The United States Wikipedia

Stu Law Tax Law Symposium 2019 Panel 3 Federal Estate And Gift Tax Youtube

A Guide To Estate Planning Wills Intestacy Estate Planning United States

Portability Of The Estate Tax Exemption Cdh Law Pllc

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Estate Gift Tax A Moving Target But No Clawback Is Certain Karp Law Firm

Estate Tax Portability What It Is And How It Works

Distributable Net Income Tax Rules For Bypass Trusts

:max_bytes(150000):strip_icc()/senior-couple-outdoors-together-557921553-578501e63df78c1e1f3fc024.jpg)

The Portability Of The Estate Tax Exemption

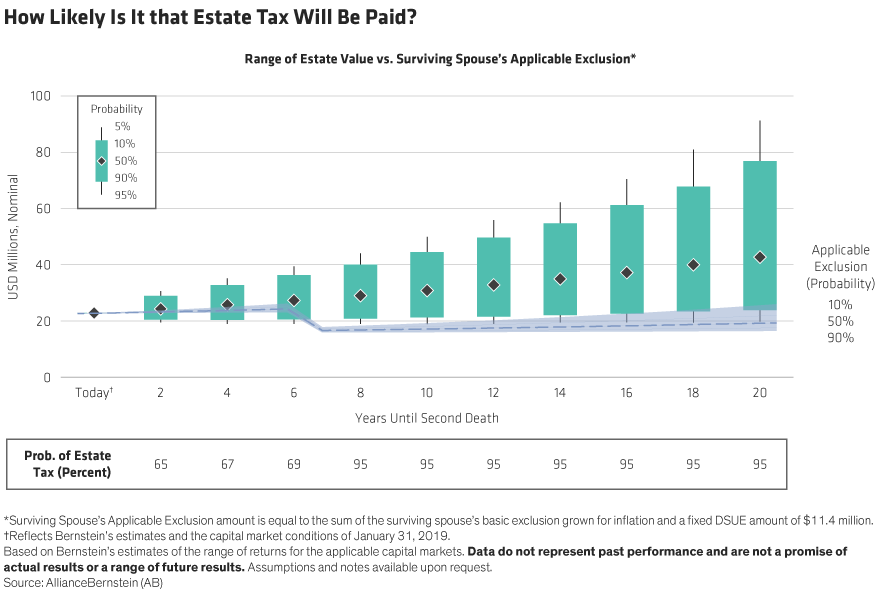

Will Your Estate Be Taxable In The Future Context Ab

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

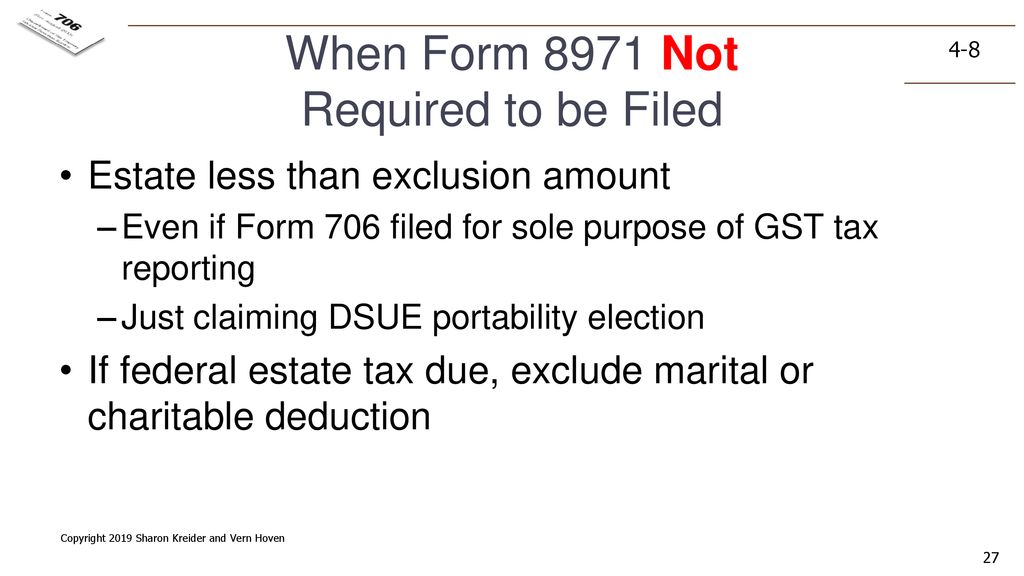

Form 706 Extension For Portability Under Rev Proc 2017 34

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group